如果這次也繼續出現之前週期中出現的相同模式,那麼專家就何時可能出現比特幣牛市的下一個高點提供了解釋。

比特幣之前的周期表明,牛市頂部就是這種情況。

分析師 Ali 撰寫了一篇關於 X 的新文章,其中討論了比特幣最近兩次牛市相互關聯的方式,以及這可能對當前加密貨幣週期產生的影響。

為了進行比較,分析師參考了一張圖表,該圖表說明了每個週期中的價格變動,其中週期底部是所有週期的起點。

根據該圖,很明顯,比特幣最近兩次牛市的峰值發生在各自周期底部以來的大約同一時間段。

已確定當前週期的底部將是 2022 年 FTX 崩盤後出現的低點。如果當前週期與從該底部開始的前兩個週期一致,那麼它仍然有大約600 天,直到達到與最近一對牛市達到最高點時相同的位置。

Ali 補充道:“預測表明,下一個市場高峰可能會在 2025 年 10 月左右到來。” 「如果比特幣從各自的市場底部反映了之前的牛市(2015-2018 年和 2018-2022 年),那麼下一個市場高峰可能會在那個時候到來。” 由此看來,比特幣還有600天的正面動能!

比特幣有可能跌破歷史線。 近來

比特幣的短期價格走勢令投資者感到不快,自現貨ETF獲得美國證券交易委員會(SEC)許可以來,該加密貨幣已大幅下滑。 儘管事實上比特幣從長遠來看可能有一個有利的前景。

在以某種方式回到目前交易的 40,000 美元水平附近之前,加密貨幣甚至跌至早些時候交易的 38,500 美元大關。

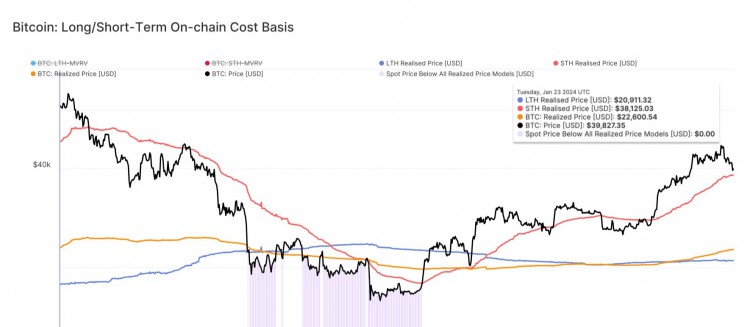

在最近的下跌過程中,比特幣危險地接近重新測試“短期持有者實現的價格”,這一水平對於該資產的整個存在至關重要。

The term "realized price" refers to a statistic that is used to monitor the price at which the typical investor in the Bitcoin market purchased their coins. The fact that the current price is higher than this number naturally indicates that the average holder in the sector is making a profit, whilst the fact that it is lower than the line indicates that losses are the predominant form of holdings.

According to what Ali has said in another post on X, the "short-term holder" group will find themselves in a position where they are losing money if the price of the cryptocurrency falls below the 35,130 mark.

Short-term holders, often known as STHs, are investors in Bitcoin who have acquired their coins within the last 155 days after the first purchase. The price that they have really achieved is now at the level of $38,125. When this line has been broken repeatedly in the past, it has often indicated that the coin would remain below it for a longer period of time.

Bitcoin has been able to avoid a retest of this level up to this point; but, if the present drop continues, it may even be able to break through it. The expert notes that "this potential BTC dip might trigger a new wave of panic selling as these holders will seek to minimize losses," and that there might be a new wave of selling.