Main points

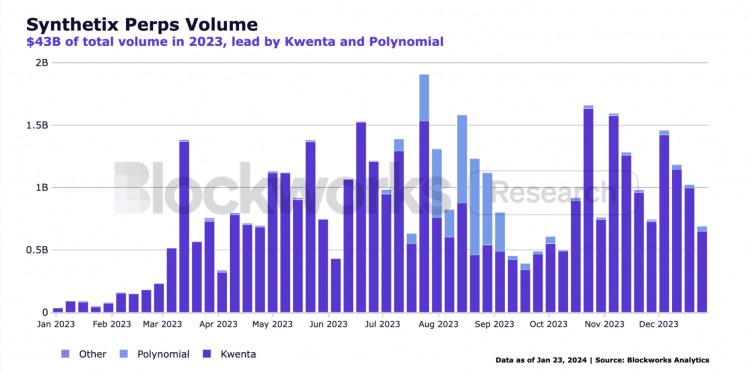

2023 is shaping up to be a very successful year for Synthetix. Perps V2 quickly achieved product-market fit, with total transaction volume of approximately $43B, fees generated of approximately $36.5M, dynamic financing rates to keep open interest balanced, and Synthetix transactions generating revenue for the Optimism mainnet sequencer 1460 ETH.

Highlights in 2024 will include the launch of many different new deployments. The first includes Andromeda, a combination of Synthetix V3, Perps V3 and USDC as the only collateral asset, being deployed on Base and slowly rolling out. Thereafter, Synthetix will focus on Carina, Perps V3 on the Ethereum mainnet, Synthetix Chain (the OP Stack rollup that serves as the home base for SNX stakers), and more cross-chain deployments

The Spartan Council voted on two major token economic improvements: SNX inflation has been eliminated, and fees incurred by Andromeda Base deployments will include 20% integrator share, 40% buyback and burn, and 40% sUSD fees destroy.

2023 is an incredible year for Synthetix as it was able to emerge from a severe bear market and create and scale entirely new products to find product market fit in a short period of time. This is of course Synthetix's Perps V2 product, which has a total transaction volume of approximately $43B and generated fees of approximately $36.5M in 2023. These fees are directly beneficial to SNX stakers as they are used to destroy sUSD and eliminate an equal amount of debt for all stakeholders.

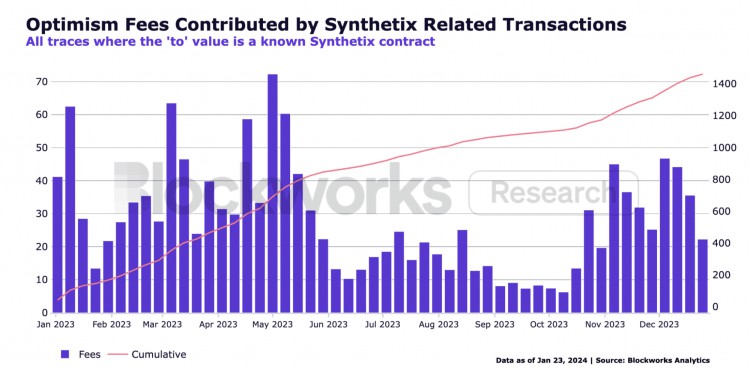

Synthetix is also a key driver of Optimism's success, as it is a significant component of the chain's TVL, activity and revenue. Synthetix’s TVL this year reached $316 million, accounting for approximately 34% of the total TVL on the Optimism mainnet. In addition, Optimism mainnet transactions related to Synthetix (including any spot and Perps transactions and SNX staking) brought in approximately 1460 ETH (approximately $3.5 million) in transaction fees in 2023, accounting for approximately 7.3% of overall chain revenue.

While some attributed the increase in activity to the 5.9 million OP incentives (approximately $9 million at the time) that Synthetix and its frontend used as fee rebates for traders on the platform, after the incentive period ended, trading volumes remained relatively higher. Synthetix’s average daily trading volume remains at $151M compared to $155M during the incentive period, and even achieved its maximum weekly trading volume during the week of October 23rd at 1.6B. This means that these incentives create a certain stickiness for users and volume.

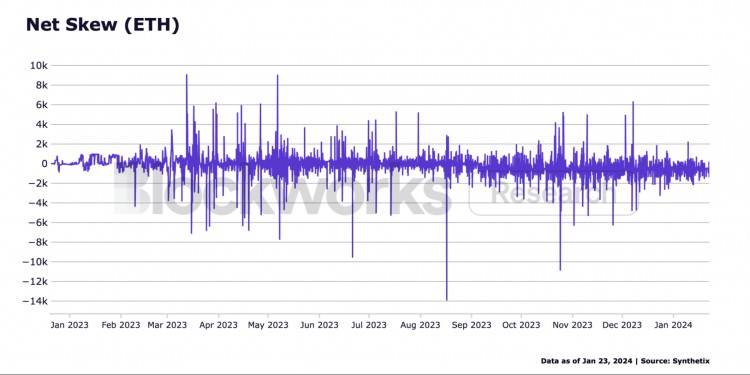

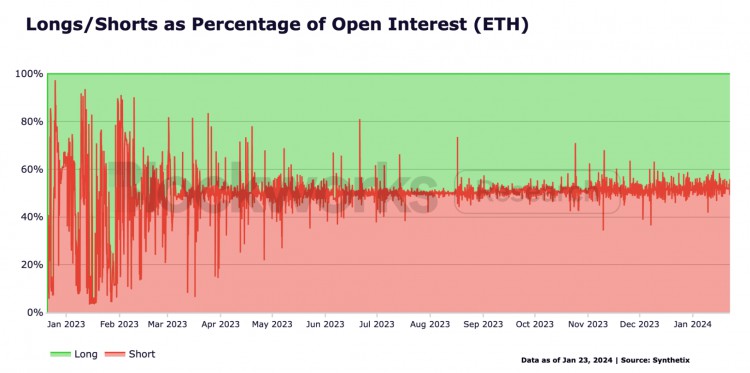

While transaction volume and fees are obviously important, an important aspect for SNX stakers is the ability to dampen the risk of market volatility. This is achieved through Perps V2’s dynamic funding rate. Dynamic funding rates take into account not just skew, or the difference between longs and shorts, but also velocity. This means that if there is a persistent long-term bias over time, funding rates will continue to increase over time. This system greatly incentivizes traders to arbitrage these funding rates and keep open positions. Although open interest fluctuated significantly in early 2023 due to a very small cap on open interest, it remained very stable for most of the year, with the occasional small spike.

Other competitors such as GMX are now incorporating dynamic funding rates into their products due to their success in reducing market risk for liquidity providers.

Backed by the Perps product that has found clear product-market fit, Synthetix enters 2024 with ambitious plans to upgrade its product line, expand cross-chain Perps trading beyond the Optimism mainnet, and add new collateral types to maximize effectively improve liquidity and capital efficiency, and incentivize the front-end to create an enhanced user experience comparable to centralized exchanges.

Synthetix V3 和 Perps V3

Synthetix is currently migrating its new products to current V2x systems: Synthetix V3 and Perps V3.

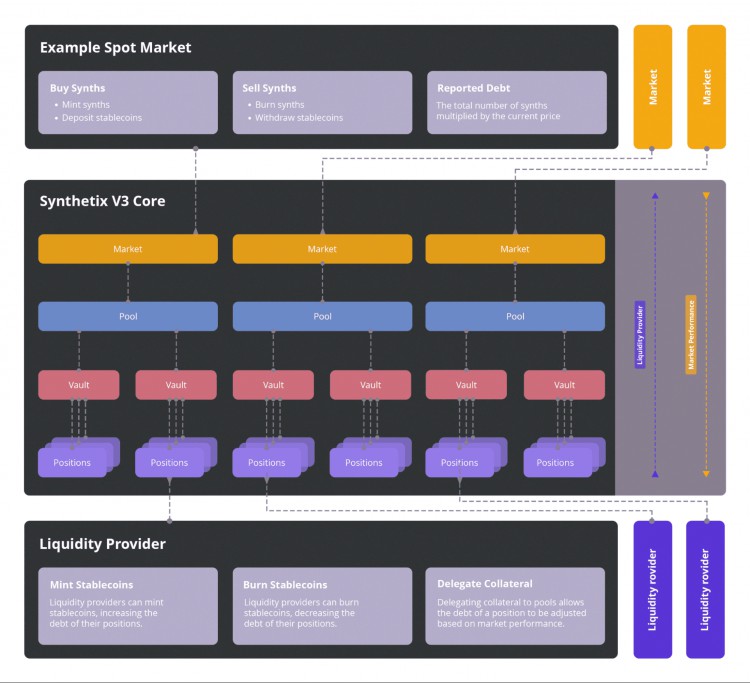

At its core, Synthetix is the liquidity layer for financial markets. In V2, SNX stakers borrow against their SNX and assume debt positions. This debt is then represented by all stakeholders' respective shares of the total debt of the system. Synthetic asset markets are created using this debt as traders take advantage of the value created by this global pool of debt. As positions are opened and closed, the debt system is updated to reflect changes in balances. As mentioned previously, this makes SNX stakers a temporary counterparty to traders in perpetual operator situations, as dynamic funding rates have been shown to keep open interest balanced.

In V3, Synthetix takes the concept of liquidity layers to the next level by creating a more modular system. This gives developers and users the flexibility to experiment at different layers of the liquidity stack.

The core of V3 starts at the pool level. Each pool represents a separate source of debt and liquidity, which is then used to provide liquidity to the market. Debt and liquidity come from vaults, where liquidity providers deposit their assets and delegate their collateral to a pool. Each pool has a vault for each collateral type it accepts, and pools can acquire any collateral assets they want. The pool can then provide collateral for the market of their choice. While these can be off-the-shelf or permanent products that Synthetix already offers, there are also opportunities for developers to build entirely new markets.

This design allows for experimentation in different markets while allowing liquidity providers to choose the level of risk they take. The main pool is the Spartan Pool, and its allocation, mortgage assets and market will be determined by the Spartan Council. Most liquidity provider stakers will choose to offer this more secure system, but if someone wants to build a permissionless perpetual futures market with higher risk but potentially higher rewards, then it is possible to stake this market now .

So far, several teams have expressed a desire to build products using V3 infrastructure. The first is Overtime Markets, a sports betting platform built on Thales that is currently migrating its existing infrastructure to V3. Given that LPs have earned over 70% APR in less than a year, it's likely that this market will be absorbed by Spartan Pool shortly after launch. Other protocols that have expressed interest in building on V3 include CasinoFi project Betswirl and TLX, which is creating a tokenized version of its Synthetix perps position. Other market types have also been proposed, such as options markets, insurance markets, and prediction markets.

While much of the focus this year will be around the proliferation of Perps products to enhance user experience and portability across multiple chains, V3 will be available for experimentation to allow new markets to emerge.

Synthetix is also looking to release the next generation of its Perps product, which will serve as a marketplace under V3 infrastructure: Perps V3. This upgrade will include improvements to the underlying architecture of Perps to enhance the overall user experience. This means improved trader latency, a native cross-margin system, expanded collateral options (including trading with synthetic assets like sETH and sBTC), and progressive liquidations to reduce mezzanine liquidation risk from MEV seekers and NFT-based accounts . This improved user experience aligns well with Synthetix’s plans to expand Perps activity in 2024.

Roadmap 2024

Synthetix is entering a critical stage of its development. While the Perps V2 product had clear product-market fit, the user experience was limited, inhibiting potential growth and activity. Perps V3 is improving the Perps trading experience, but there is still a long way to go to establish parity between the on-chain trading experience and that offered by centralized exchanges. By 2024, Synthetix and its ecosystem hope to close this gap as much as possible.

One of the limitations of the current perps system is that users can only trade on the Optimism mainnet. While the chain itself provides a good enough user experience, porting to other chains with different user groups allows Synthetix to generate more activity and more revenue, and build its brand in different communities.

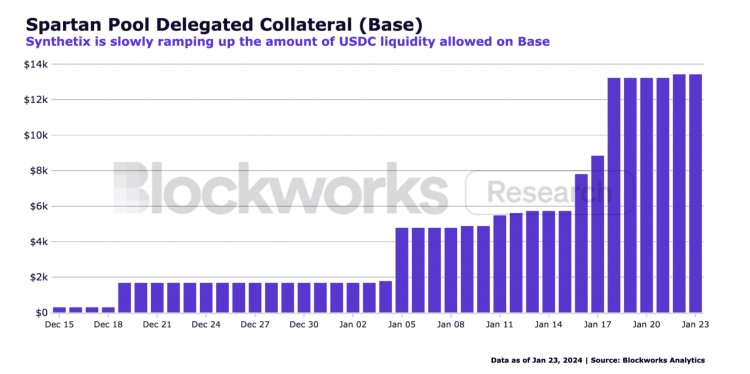

The experimentation and process of migrating to other chains will begin with a series of products from Synthetix called Andromeda, which includes Synthetix V3, Perps V3, and USDC as the only collateral type. This environment is useful for testing the new product itself, while also understanding the extent of demand for using USDC instead of the SNX native token to provide liquidity.

Synthetix is specifically testing USDC because of its potential for better liquidity. Since USDC is a stablecoin, it imposes much lower LTV requirements on liquidity providers, thereby increasing capital efficiency and not requiring LPs to have significant market exposure. Therefore, this increases the expected annual interest rate for liquidity providers. For example, if we assume SNX stakers earn 3% APR at 500% CR, then USDC would earn 13.6% at 110% CR, all else being equal. In addition to governance voting, there are plans to add yield-bearing stable collateral such as sDAI to further drive this potential gain. On top of that, the ability to take on sUSD debt elsewhere and earn additional yields makes it extremely attractive to yield farmers and yield maximizing vaults, which in turn attracts significant liquidity to Synthetix.

The first deployment of Andromeda is currently rolling out on Base. This will be the first testing ground for Perps V3 and USDC as primary collateral. The total amount of USDC allowed will slowly increase as liquidity and open interest are allowed to trade on the perpetual market. Kwenta, the largest Synthetix front-end, also said that they will use incentives to "actively push" users to adopt V3 once the upgrade is completed and there is enough liquidity to meet the needs of traders.

The deployment on Base comes with the launch of Infinex, a new front-end focused on providing traders with an enhanced user experience and creating a liquidity flywheel for perpetual trading. Infinex was founded by Synthetix founder Kain Warwick and uses SNX as its governance token. They will also take a front-end fee share, 20% of the fees generated by Perps V3, to buy back and stake SNX tokens to facilitate the flywheel of further liquidity. Infinex’s highlight features include the ability to log in with username and password, multi-factor authentication and cross-chain deposits. For users, it feels like using an exchange, but the backend is enabled by decentralized and permissionless liquidity.

After a successful deployment on Base, Synthetix will consider deploying Andromeda to the Optimism mainnet, potentially adding ETH as an additional collateral asset. This will run in parallel with the current Perps V2 system and will measure SNX’s preference for providing liquidity relative to USDC and ETH. Synthetix will then look to expand to other EVM chains and rollups to see where they can generate more users and liquidity. While the next destination has yet to be determined, the community seems to prefer Arbitrum at this stage.

In addition to the proliferation of Andromeda, Synthetix is also working on a specific deployment of their Perps product on the Ethereum mainnet, which they are calling Carina. While using Ethereum is obviously much more expensive and slower than deploying on a rollup, this is a protocol designed specifically for leveraging Synthetix perps or a specific set of traders who have infrastructure on mainnet. For these entities, the ability to bridge aggregations increases their risk. The first protocol explicitly built on Carina will be Ethena, a stablecoin project that uses a delta neutral position to back its stablecoin USDe by holding stETH and shorting Perp. Ethena has earned over $130 million in TVL during its closed alpha period, some of which will be hedged via Perps when Carina officially goes live. Since stETH is native to Ethereum, this product is ideal for reducing risk and maximizing composability.

Synthetix is also exploring the possibility of creating an OP Stack aggregation called Synthetix Chain. The purpose of this is to create a central governance place for SNX stakers to borrow against collateral and transfer their sUSD to the chain of their choice, as well as distribute fees incurred across different deployments. Debt from the current V2x system will be fully migrated to this Synthetix chain along with SNX stakers.

SNX Token Economics Improvements

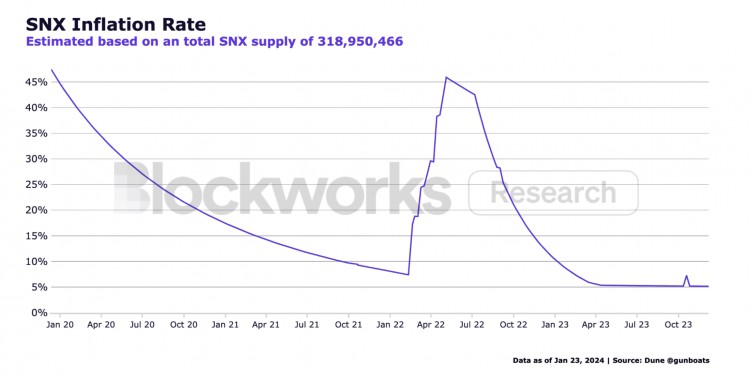

On December 17, the Spartan Council voted to reduce SNX inflation to zero. Inflation has been a huge deterrent to users and investors holding SNX in the past, given that previously extremely high inflation diluted holders and created significant selling pressure on the token. Although inflation fell to around 5% for all of last year, many who were previously upset by SNX inflation may now be taking a second look.

Another improvement in token economics comes from the deployment of Andromeda on Base. The Spartan Council approved SIP-345, 50% of the fees generated by the protocol (after the pointer fee share) will be used to buy back and burn SNX. The remaining 50% of net protocol fees will be burned in sUSD as currently implemented. While not formalized through governance, it is expected that the integrator fee share will be 20% and will be paid directly in sUSD through the V3 Reward Manager contract.

This integrator fee sharing will help crea