Why are most people more likely to lose money in Crypto’s bull market? What should we do?

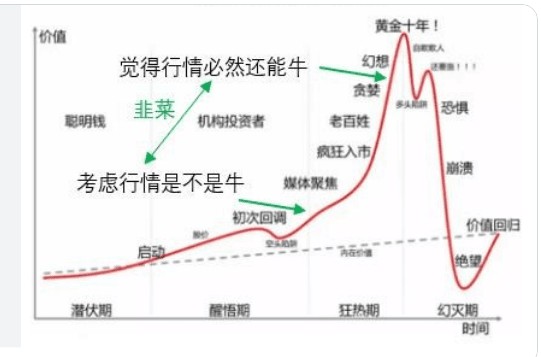

In a bull market, it seems that everyone is making money, but it is actually a beautiful trap. Investment guru Graham said: The bull market is the main reason why ordinary investors lose money.

Let’s talk about the operating rules behind financial markets and the principles of behavioral economics involved.

1. Most people will eventually lose money

First of all, as long as it is venture capital, no matter in a bull market or a bear market, most people will eventually lose money and leave the market. This is an eternal law and has never changed.

So why is it more dangerous to invest for the first time in a bull market?

Because in a bull market, as the market goes up, everyone makes money. This rapid accumulation of wealth will attract a large number of novices to enter the market.

As an investment novice, I have never bought cryptocurrency before, especially after hearing about the relatively large wealth effect, such as a certain currency multiplying 100 times in a short period of time. I don’t know much about the financial market. I watch my friends around me start to make money, so I enter the market and follow the trend. , ultimate loss is almost inevitable.

I don’t even have much experience in traditional stock investment, so I just jumped into the highly volatile market like crypto. This is why I never recommend people around me to speculate in coins, nor do I give investment advice to people who haven’t paid.

There are two reasons for the loss: entry timing and irrational behavior.

The timing of entering the market means that most people only start paying attention to the crypto market in the middle or late stages of the bull market. For example, right now, I have friends from traditional finance asking me what is an encryption algorithm and why is Bitcoin valuable? White question.

Because my Sober chat options knowledge planet actually has many A-share and US stock options players who are not familiar with crypto.

At this time, the market is already at a relatively high level. No one thinks that the odds of Bitcoin are still high right now?

Irrational behavior refers to chasing ups and downs, frequent trading, emotional decisions and other irrational decisions, which will lead to expanded investment losses.

(1) Time to enter the market

Investors always think that they can buy at a low point and sell at a high point, making a huge profit from it.

But in fact, for example, during the crypto bear market in October last year, bloggers from a certain build actually started posting chicken soup articles.

At present, BTC continues to rise sharply, has broken through the previous high several times, and has entered the middle of the bull market. Some new players are rushing to enter the market, and what awaits them is often not a continued rise, but a sideways movement or a sudden plunge.

Therefore, entering the market late is an important reason for losses.

(2) Irrational behavior

There are many irrational behaviors in investment. For example, everyone knows to buy low and sell high. Buy more when it is cheap, and sell appropriately when it reaches a high level. But in the market, most people do the opposite and actually sell low and buy high.

The position structure of an investment novice is similar to an inverted pyramid. At the beginning, I invested a little money to test the market. After I found that I was making money, I started to invest more principal. (As shown below)

When the market begins to fall, losses will soon occur due to the increased investment costs. After losing money, they will say, this is a lie, and I will never touch stock funds again.

But the market will not continue to fall. When the bull market comes again, everyone around you is trading in stocks. You may even see your colleague sitting next to you making one year's salary by trading stocks in one month.

At this time, you are no longer calm, for fear of missing this wealth opportunity.

At the beginning, I just invested 10,000 U to test the waters, and soon made 100% profit. You regretted that you invested too little principal, so you continued to invest 100,000 U, and soon made 100% again. Continuous profits make you full of confidence, so you sell your house and buy various altcoins.

Eventually, the market will turn downward sooner or later, and not only the previous profits will be lost, but also the down payment will be lost.

You may ask, did such a plot really happen?

I would say yes, it happened in traditional financial markets in 2007 and 2015. Why am I so familiar with this plot? Because I have experience in the industry.

On the other hand, we imagine that if it is a bear market and the market falls all the way, the risk will be smaller. Because you will control the principal invested and invest carefully, you will not lose too much at this time.

The above example is a typical novice’s investment journey. We will find that novices who had no intention of entering the market can't help but follow the trend and invest in the stock market when they see people around them making money.

This is called the bandwagon effect in psychology, which means that individuals are influenced by the group and will doubt and change their opinions, judgments and behaviors in the direction consistent with the majority of the group.

Most of the time, the herd effect helps us survive and integrate into this society. But in the financial market, following the herd is poison and a dangerous behavior that leads to investment losses.

In the financial market, there are its own rules of the game. Don't think that you can resist the temptation of human nature before you have played this game. Because you don’t know to what extent your greed and fear will be amplified by the market.

2. How to reduce losses

If you are a novice investor who has just entered the market and encountered a bull market that only happens once in several years, here are some suggestions.

Don't use leverage.

No matter how confident you are about the market, never borrow money to invest. Because if you make a mistake once, you will lose all your principal.

Invest your spare money and control the principal invested.

The crypto market cycle is very short, usually with a halving cycle of four years. Therefore, the investment principal should be at least spare money that will not be used within four years.

Try to avoid losses.

When investing for the first time, the most important thing is not how much you make, but not losing money, or losing as little as possible.

It can be said that it is extremely difficult to exit with a profit after entering the market for the first time. When you see experts who can make long-term profits, they are all experienced veterans.

Finally, investment philosophy cannot be passed from one person to another. You can only get it with your own time and effort.

No matter how much I say above, it is not as real as experiencing a loss personally. If tuition fees have to be paid sooner or later, then it is always better to experience it sooner rather than later.

I have read so much, if you think it is helpful to you, please remember to like and comment.

Finally, if you are a steady investment player, you can actually invest in Bitcoin at this stage, then you are welcome to use my link to register for the largest exchange - Binance

Registration link: https://binance.com/zh-CN/join?ref=148766089