今晚,虛擬貨幣市場遭遇拋售風暴!

1月3日20點,比特幣價格突然暴跌,短短10分鐘暴跌超過4,000美元。 截至21點20分,比特幣價格短期止跌反彈。

1月3日20:00開始,比特幣價格迅速下跌,5分鐘內就被空手趕出了「瀑布」。 失守45,000美元關鍵點後,比特幣看漲防線崩盤再次下跌,跌破4,4,000美元、4,3000美元、4,2000美元整數關卡。

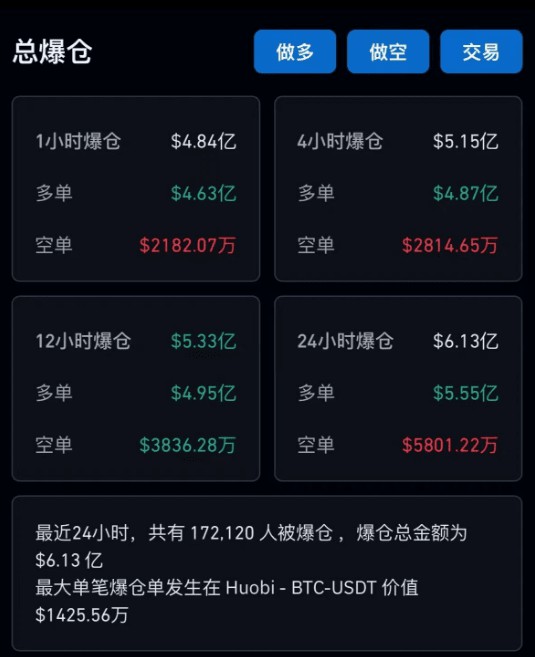

根據Coinglass統計,截至1月3日21:00,24小時內已有超過17萬人全網平倉,總平倉金額達6.13億美元(約43.8億元)。

由於比特幣價格大幅下跌,虛擬貨幣市場遭遇血洗,多種主流虛擬貨幣價格大幅下跌。 截至21點20分,以太幣跌幅超過7%,瑞波幣跌幅超過12%,狗狗幣跌幅超過10%。

中國證券報記者註意到,市場投資者對於比特幣未來走勢有較大分歧。 有分析指出,比特幣現貨ETF近期將在美國獲準的預期,加上聯準會降息預期不斷升溫,引發了投資者對虛擬貨幣市場的投資熱情,推動了此前比特幣價格的飆升。 今天的大幅下跌可能是由於近期價格上漲過快而導致投資者傾向於獲利了結造成的回調。

鏈上分析師阿里在社群平台上發布的數據顯示,過去10天裡,比特幣礦工賣出了約4,000枚比特幣,總價值超過1.76億美元。

在消息面上,當地時間1月3日,Matrixport研究報告顯示,由於所有比特幣現貨ETF申請未能滿足其中一項關鍵要求,SEC(美國證券交易委員會)預計將在1月拒絕所有申請。 目前,美國證券交易委員會投票委員會不太可能批准比特幣現貨 ETF,這將使比特幣合法化。

Hong Shuning, a senior Bitcoin researcher, told a reporter from the China Securities Journal that the research report released by Matrixport today predicts that if the SEC refuses to approve, there will be large-scale liquidation activities in the market, and the price of Bitcoin will therefore fall to US$36,000 to US$38,000. The market was affected by this news, causing panic selling. However, before the official news from the SEC is released, the market may undergo major adjustments, and investors should pay attention to the risks.

Since the second half of 2023, the price of Bitcoin has continued to rise, with a cumulative increase of more than 145% in 2023. Affected by the upward trend of the overall market, the total market value of virtual currencies has grown rapidly. According to data from Coingecko, the current total market value of virtual currencies is close to 1.5 trillion US dollars (approximately 10.7 trillion yuan).

Although today's plunge has caused heavy losses to many investors, there are still many investors who are bullish on Bitcoin. According to Coinglass statistics, in the past three months, the long-short ratio of investor positions has shown a trend of first increasing and then slowly declining. It is still above the 1.25 level. At the same time, the ratio of long-short positions is 1.09:1.

Ayyar, vice president of international markets at virtual currency trading platform CoinDCX, said that the current Bitcoin rally is largely based on the expectation that the Bitcoin spot ETF will be approved. If the Bitcoin spot ETF is once again rejected by U.S. regulators, the current Bitcoin rally may come to an end and the correction will continue. Therefore, many speculators currently tend to take profits, and the virtual currency market has fallen back.

The application process of Bitcoin spot ETF in the United States has been tortuous, which can be traced back to 2013 when the wealthy Winklevoss twin brothers applied. However, it has been repeatedly rejected by the SEC, mainly due to concerns about the greater risks for investors in the Bitcoin market.

Since last year, many financial institutions such as BlackRock have submitted applications for Bitcoin spot ETFs, attracting market attention. According to incomplete statistics, 13 applicant institutions have currently held 24 meetings with the SEC to discuss the relevant details of the Bitcoin spot ETF.

Recently, Bloomberg ETF analyst Eric Balchunas said: “If we don’t see the adoption of a spot Bitcoin ETF in the next two weeks, it may be because the SEC wants longer to resolve the matter.”