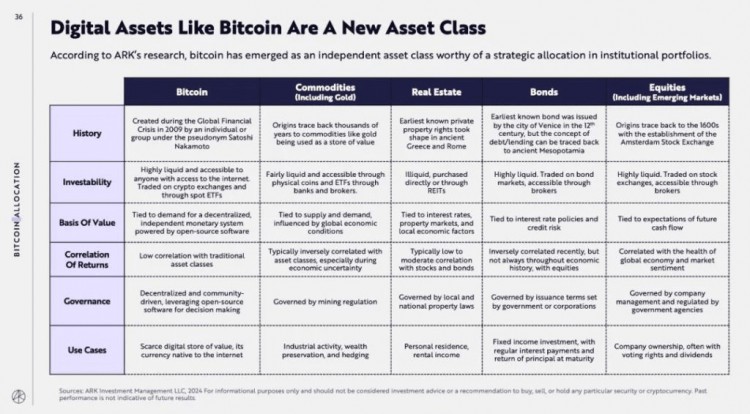

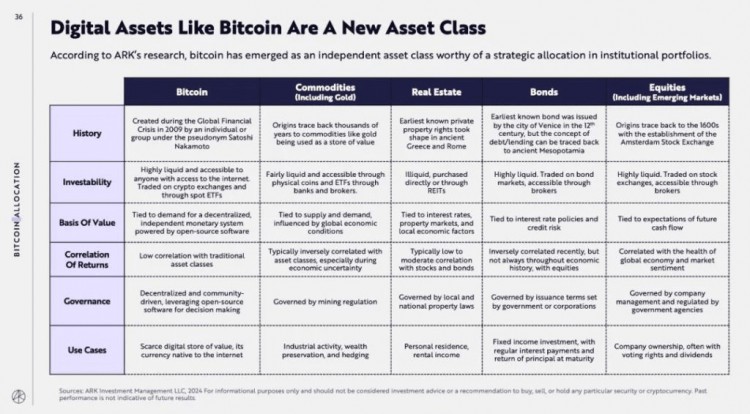

On February 2, ARK Invest, a Bitcoin ETF issuer and controlled by Cathie Wood, released a 160-page annual report titled "Big Ideas 2024: Subverting Conventions and Defining the Future" .According to ARK’s research, Bitcoin has emerged as an independent asset class worthy of strategic allocation in institutional portfolios. In the "Bitcoin Allocation" section, the report compares Bitcoin with commodities, real estate, bonds, and stocks from six dimensions: history, investability, basic value, rate of return, management, and cases.Bitcoin outperforms all other assets over longer time frames, the report said. For example, over the past seven years, Bitcoin's annualized return has averaged about 44%, while the average annualized return of other major assets has been 5.7%.Investors with a long-term view will benefit over time. Bitcoin’s volatility can mask its high returns. However, a long-term investment perspective is the key to investing in Bitcoin. Instead of asking “when,” ask “how long.”Historically, investors who buy and hold Bitcoin for at least 5 years have made a profit regardless of when they purchased it.Allocating $250 trillion of the world's investable asset base to Bitcoin would have a significant impact on Bitcoin prices. For example, with an allocation of 1%, the Bitcoin price would reach approximately $120,000. With an allocation of 4.8%, the Bitcoin price would reach $550,000. With an allocation of 19.4%, the price of Bitcoin would reach $2.3 million.In the "Bitcoin In 2023" section, the report stated that in 2023, the price of Bitcoin surged 155%, and the market value increased to US$827 billion.Bitcoin is evolving into a reliable safe-haven asset. As macroeconomic uncertainty increases and people's trust in traditional "flight to safety" decreases, Bitcoin has become a viable alternative.