Is the stock market rally getting too hot for the Fed? That’s the increasingly pressing question for Powell as a three-month equity surge complicates his efforts to cool the economy.

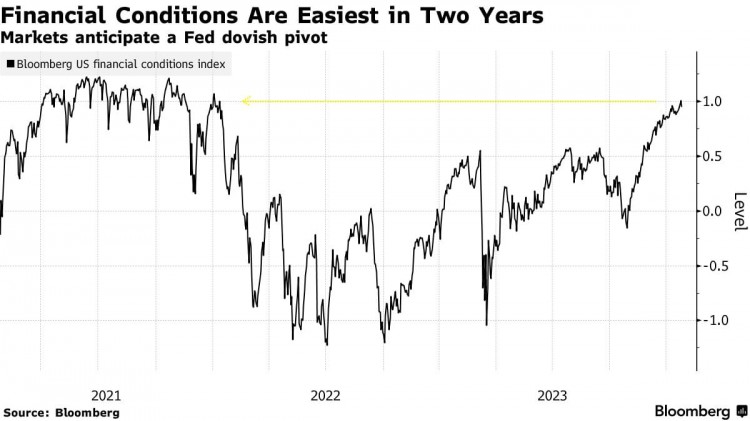

The S&P 500 Index capped a fifth straight week of gains on Friday, adding $8 trillion in market value. The epic rally is pushing a gauge of financial conditions to its loosest since early 2022.

While policymakers rarely discuss this dynamic out loud, rising stock prices and the wealth effect they create for Wall Street and Main Street could add new momentum to the spending-and-investment cycle that’s already working against inflation-fighting efforts. A recent paper on the National Bureau of Economic Research website calls the stock market “the single most important factor affecting financial conditions,” and notes that influencing stock prices is a key channel through which monetary policy works.

While investors would undoubtedly welcome dovish signals from the Federal Reserve when it meets this week, there are risks to prematurely easing monetary policy, including: the wealth effect from a booming market that could work against the Fed’s efforts to cool excessive price pressures.

“When the stock market booms in a full-employment economy, as it has recently, it dramatically increases household wealth,” says Doug Ramsey, chief investment officer of the Leuthold Group. “My gut feeling is that this will add to inflation. The stock market has rallied on expectations that the Fed will cut rates, which is a form of easing in itself. Ironically, it may reduce the odds of rate cuts in the months ahead.

The S&P 500 Index gained 1% over the past five days, notching its 12th weekly advance in the past 13 weeks and sending financial conditions sharply easier. Financial conditions are a measure of how tight monetary, credit and equity markets are. In fact, conditions are now looser than they were two years ago, before the Federal Reserve began aggressively tightening policy, thanks in large part to the equity rally.

Financial conditions are at their loosest in two years

Financial conditions are at their loosest in two years

Mortgage rates fell as focus shifted to the low rates ahead, enticing homebuyers. Stocks have since returned to their record highs, potentially providing a tailwind for consumer spending. U.S. households held $43 trillion of stocks at the end of the third quarter last year, or 38% of their financial assets, according to the latest available data from the Federal Reserve.

Good financial conditions and better-than-expected economic data argue against the Fed adopting a more dovish stance, says Henry Allen, macro strategist at Deutsche Bank. He recalled that earlier in 2023, as employment continued to come in strong and inflation persisted, Powell said at a congressional hearing that the Fed would be prepared to “move more quickly” in raising interest rates.

Additionally, Powell has emphasized the importance of financial conditions broadly reflecting “the policy restraint that we are putting in place” on more than one occasion during the hiking cycle.

“Clearly, inflation is closer to target now, so this is not exactly the same as today, but the risk is that easier financial conditions are setting the stage for a reacceleration in inflation,” Ellen wrote in a note. “In this cycle, the Fed has tended to push back when financial conditions have eased.”

But the wealth effect may have already peaked. The stock market’s bull run is set to lose steam after the S&P 500 surpassed its average year-end target last week, according to Wall Street strategists. Meanwhile, 61% of Americans own stocks, mostly held by wealthier households, according to a Gallup poll last year. That leaves many insulated from recent market gyrations.

The counterargument is that if history is any guide, Americans’ stock wealth has further to climb. Since the 1940s, there have been 13 other occasions when the S&P 500 has fully recovered from a bear market trough, as it did last week. In every one of those instances, the index went on to rise further, gaining an average of 29% over the following 19 months before eventually peaking. If this bull market were to match the median advance of its predecessors, it would add about $15 trillion to the wealth of U.S. stock owners.

“People tend to spend more when they feel good about the change in their portfolio. And certainly the wealth effect can stimulate economic activity,” said Ed Yardeni, founder of Yardeni Research Inc. “The risk is that the Fed’s headache shifts from price inflation to asset inflation.”

The article is forwarded from: Jinshi Data